I have had a number of clients who have been really pushy, and demanding. I am in what is described as the 'rent-space-for-showcase' business. These clients have demanded high discounts, and good allocations from us on the supplier side. Some had even informed me that they were willing to let go of taking part in the showcasing project initially.

As their demands had been what is deemed excessive, I decided to take a step back. Indeed, one would call my way as 'not being pushy'. So much so, I had taken my own sweet time to get back to them. Yet, the places allocated to these guys is pretty much prime spots.

Perhaps, for some, this approach would not work, as there will be other clients who are serious about participation. I discerned that this guys were going for the 'waiting game'. The party that relents

the first will lose. Finally, they called up, and asked how they were supposed to join.

The ball was definitely in my favour. Yes, as you can see, pushy does not work each time.

Saturday, October 24, 2009

Thursday, October 22, 2009

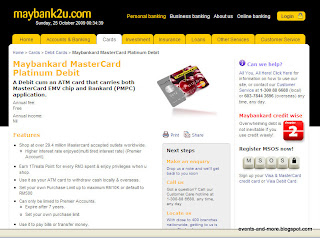

Malaysia: Introducing Maybank Mastercard Platinum Debit

Just when we thought we had heard the last of the Visa Debit cards, Maybank is now introducing the Maybank Mastercard Platinum Debit.

The joke of the day lies in the fact that Maybank Visa Debit already has a cherry background, and here is Maybank trying to introduce a "Platinum" status card to the Mastercard Debit, where customers have already associated the cherry with the Visa Debit.... man, you guys need to get creative.

All black is better than all cherry.

Click here for more information.

The joke of the day lies in the fact that Maybank Visa Debit already has a cherry background, and here is Maybank trying to introduce a "Platinum" status card to the Mastercard Debit, where customers have already associated the cherry with the Visa Debit.... man, you guys need to get creative.

All black is better than all cherry.

Click here for more information.

Malaysia: Bankcard/E-Debit System Not Very STABLE!

From my previous experience of using my Maybank Bankcard or e-debit card (as they call it in Malaysia) I have found that a lot of terminals have problem with the system.

THE SCENARIO

I had made a transaction on an EON bank card terminal. The amount swiped was Rm1,000.00. However, the terminal did not print out the receipt, as per the normal. Yet, when I checked on my online banking, I found out that Rm1,000.00 had already been transferred over to card terminal account..

Fortunately, the merchant was kind enough to "reserve" the transaction for me. For the next two weeks thereafter, I was living from hand-to-mouth.. as my bank account had almost zero savings... and had to call the bank up to expedite the refund of my monies.

From discussions with friends who have used the Bankcard/E-Debit feature, it seems that it is an occuring problem amongst the other E-Debit cards as well....

CONCLUSION

In return, I have found that the cards with the VISA or MASTERCARD logos are much more reliable, with less terminal error problems occuring. Although they are not as safe as the E-Debit cards, well...

I now keep the E-Debit cards for the purpose of money withdrawal, and the occasional small amount purchases..

THE SCENARIO

I had made a transaction on an EON bank card terminal. The amount swiped was Rm1,000.00. However, the terminal did not print out the receipt, as per the normal. Yet, when I checked on my online banking, I found out that Rm1,000.00 had already been transferred over to card terminal account..

Fortunately, the merchant was kind enough to "reserve" the transaction for me. For the next two weeks thereafter, I was living from hand-to-mouth.. as my bank account had almost zero savings... and had to call the bank up to expedite the refund of my monies.

From discussions with friends who have used the Bankcard/E-Debit feature, it seems that it is an occuring problem amongst the other E-Debit cards as well....

CONCLUSION

In return, I have found that the cards with the VISA or MASTERCARD logos are much more reliable, with less terminal error problems occuring. Although they are not as safe as the E-Debit cards, well...

I now keep the E-Debit cards for the purpose of money withdrawal, and the occasional small amount purchases..

Singapore: Citibank ATMs abound only in shopping malls.

I thought my eyes were about to pop.. at almost every major shopping establishment in Singapore that I went to, I could practically find a Citibank ATM.

As most may know, I currently hold a Citibank Visa Debit card. I applied for this card after being told that the conversion rates for this card is low, and fee-free as well.

As of date, I have yet to find many Citibank ATMs around any of the shopping malls around Kuala Lumpur, and could never withdraw any money since it is considered a foreign card (RM10 chargeable for withdrawals! How crazy is that!).

The only time I have ever used my Citibank Visa Debit around KL is when I had needed to make payments at the counter....

Perhaps Singapore is less strict on foreign banks, but in Malaysia, it is hard to find many Citibank branches around here.. and the nearest one is in Puchong, where I had made a complaint about their service! So the only way I could transfer money to my Citibank savings account was through bank-to-bank transfer, and that costs RM2 per transaction (free in Australia).

It was a pity that I could not find a single Citibank ATM at the Changi International Airport, although there was a humongous annoying big Citibank bunting right in the middle of their departures terminal.

How deceiving that was! I ended up exchanging my Australian dollars (since Australian and Singapore currently have almost similar exchange rate) at the exchange bureau in the airport and at Chinatown (better cash rates), and not using my Citibank Visa Debit card thereafter.

Oh Well.

As most may know, I currently hold a Citibank Visa Debit card. I applied for this card after being told that the conversion rates for this card is low, and fee-free as well.

As of date, I have yet to find many Citibank ATMs around any of the shopping malls around Kuala Lumpur, and could never withdraw any money since it is considered a foreign card (RM10 chargeable for withdrawals! How crazy is that!).

The only time I have ever used my Citibank Visa Debit around KL is when I had needed to make payments at the counter....

Perhaps Singapore is less strict on foreign banks, but in Malaysia, it is hard to find many Citibank branches around here.. and the nearest one is in Puchong, where I had made a complaint about their service! So the only way I could transfer money to my Citibank savings account was through bank-to-bank transfer, and that costs RM2 per transaction (free in Australia).

It was a pity that I could not find a single Citibank ATM at the Changi International Airport, although there was a humongous annoying big Citibank bunting right in the middle of their departures terminal.

How deceiving that was! I ended up exchanging my Australian dollars (since Australian and Singapore currently have almost similar exchange rate) at the exchange bureau in the airport and at Chinatown (better cash rates), and not using my Citibank Visa Debit card thereafter.

Oh Well.

Australia: Myer One cardholders - More places to earn credit.

I've held a Myer card since my Toowoomba undergraduate days. Yet, I rarely used the card- as I barely did much shopping there. Granted, Myers is to the Aussies, what Isetan is to Malaysians. An upmarket retail establishment.

If I am not wrong, Coles & Myers used to be under one management.. and I used to take out my Coles card to collect the points. It was very much later that I realised that the point conversion was very much higher than what I was used to in Malaysia. It would take such a long time to collect points, that I decided to forgo bringing out the card altogether.

Currently, for a limited time period, Citibank Malaysia has launched a programme offering in exchange to its credit card-members the equivalency of 180 Citibank Reward Points to RM1.00 to be redeemed instantly at specific places.

Getting points as you buy- is a very asian thing, and currently practiced a lot by the Malaysian financial institutions for their credit card-members. It IS very evident in Japan, and South Korea, I realised when I was there. Malaysia and Singapore have yet to even compete on that level!

With this, I guess Australian shopping establishments are catching up on that practice now....

If you are a Myer One card holder, click here to find more places to collect those points!

Sunday, October 18, 2009

ING DIRECT Australia: Introducing Orange Everyday.

Originally just offering online banking products and services, ING Direct Australia is fast expanding and growing their services amidst the Global Financial Crisis. It definitely puts other established financial institutions to shame, and a run for their money!

If anyone should know, Australia is notorious for having banks that charge high monthly Transaction and Account-keeping fees that range from AUD6.00. Multiply that by 12 months, thats 12 months x AUD6 = AUD72.00! Killer Fees indeed!

Up to date, it is difficult at most Australian financial establishments to get an exemption of these fees unless the individual concerned

- is a "full time student- including international students",

- have a "working relationship" with the bank- whereby they have a deposit of a minimum amount- normally exceeding AUD50,000.00

- or, the bank just does not charge account-keeping fees!

ING Direct describes their newest financial product, Orange Everyday, as a "full fledged transaction account with all the features you expect.."

Its facilities include:

- No monthly account keeping fees.

- A Visa Debit card.

- EFTPOS facilities is available.

- Free unlimited online transactions- BPAY & Pay Anyone facilities

- Online bank cheques.

- Free use of every ATM in Australia when you withdraw AUD200 or more.

- Cash-Out Bonus (AUD0.50 cents) on EFTPOS of $200 or more.

It's definitely good news that ING Direct Australia is willing to provide fee-free during this time...

at least I do not have crack my head going around looking for more banks that offers such competitive facilities to SAVE on fees! ^^

For more information on this financial product, log on to their website.

Friday, October 16, 2009

Australia: Commonwealth Bank In Pink!

I thought my eyes were playing with me when I saw the Commonwealth Bank logo in Pink...

Yes, we did have here, the towering and majestic Menara KL Tower recently lighting up in PINK for the entire month of October! But I thought that was only limited to Malaysia!

It's good to know that as usual, Australian institutions are showing the same care for womenfolk all over in conjunction with the Breast Cancer Awareness.

G'day on ya, Commonwealth Bank!!

Wednesday, October 14, 2009

Malaysia: Introducing Citibank Visa Debit

We have all heard of Citibank Visa & Mastercard Credit Cards.. *NOW*, Citibank Malaysia has finally released the Statement Brochure for their Visa Debit cards.

What used to be just a normal ATM card, now possess the priviledges of all the Visa benefits.

Citibank Malaysia is giving to all its Visa Debit card users:

- 8 X Citi Reward Points for Petrol Purchases nationwide

- 5 X Citi Reward Points for Grocery Purchases nationwide

- 3 X Citi Reward Points for Utility Bill Payments & Book Purchases nationwide.

Offer is valid from 1st Oct- 31st Dec 2009 unless stated.

*BENEFITS* from the Citibank Visa Debit

- 1 Citi Rewards Points for RM1 spent on the card for all other purchases.

- Ability to perform internet, mail and telephone order transactions.

- Free Citibank withdrawals at over 13,500 Citibank ATMs worldwide.

- Evergreen Citi Rewards Points.

- FREE Sign & Fly Protection.

- and more to come!!

Subscribe to:

Comments (Atom)